In response to health care’s ongoing cost crisis and the growing awareness of unnecessary variation in outcomes across health systems, more and more stakeholders in the industry are embracing value-based health care. The approach emphasizes the systematic measurement of health outcomes and costs by disease, condition, or risk group and the development of customized interventions, including new approaches to care delivery, that improve the ratio of outcomes to costs for the

While some medtech CEOs have been at the forefront of this trend, many remain cautious about fully embracing a value-based strategy. Some are concerned that value-based reimbursement models—in which device makers are paid not only for the products they sell but also for the outcomes they deliver—will undermine traditional business models. Others point to the uncertainty about how quickly value-based health care will be implemented and the risk that if they move too soon, they will end up cannibalizing their existing businesses before it is absolutely necessary. Still others balk at the cost of the investments required to build the necessary capabilities.

Such caution may be understandable, but it is strategically misguided. Companies don’t have the luxury to wait. The shift to value-based reimbursement isn’t just a future possibility; increasingly, it is a reality, and it is already undermining traditional industry business models. For example, in a recent study of the economic impact of the US Medicare program’s mandatory Comprehensive Care for Joint Replacement (CJR) bundled-payment program, researchers found that payments for implants declined by 30% and accounted for about 80% of the savings under the

What’s more, the ability of medtech companies to improve health care value is proving to be an especially important criterion in fast-growing emerging markets. Demand for health care—and, therefore, medical technology—is growing rapidly in these markets. But two factors—the lack of well-developed health care infrastructures and, in particular, the absence of a critical mass of highly trained clinicians, who have been the traditional customers for medtech products—make it imperative for companies to develop new solutions that support the delivery of good health outcomes at a much lower cost. (See “ An Insider’s Guide to the Transformation of Health Care ,” BCG commentary, December 2015.)

The most important reason, however, why companies shouldn’t hesitate is that value-based health care represents an enormous business opportunity—one that medtech companies are well positioned to exploit. The industry’s traditional high-touch sales model means that medtech companies (unlike, say, payers) have strong relationships with doctors and patients, which makes them critical partners in innovating new value-based treatments and therapies. Unlike many drug companies, they have a deep understanding of care delivery for specific interventions such as joint replacement, cardiac care, or certain critical diagnostic procedures. Finally, unlike most hospitals and provider networks, medtech companies have deep financial pockets that allow them to invest in the development of standardized, scalable value-based solutions or in new innovations that materially improve the outcomes-to-cost ratio in a specific domain. These competitive strengths make it possible for medtech companies to approach value-based health care not just defensively but offensively, in the process opening up new profit pools and expanding their share of the health-care-spending pie.

To do so, however, companies need to start now to develop coherent value-based strategies and to build the capabilities necessary to execute those strategies successfully.

Three Value-Based Strategies

Although the strategic implications will vary depending on the specific sector or market, leading medtechs are already pursuing promising strategies that all companies should be considering. Here are three examples.

From Stand-Alone Products To Value-Based Solutions

The strategy that is the least disruptive to a company’s existing business model is to supplement a traditional product offering with new products or services designed to improve health outcomes, lower costs, or do both.

For a simple illustration, consider the problem of site infections that sometimes occur after the surgical implantation of cardiac devices. Such infections are relatively rare (depending on the study cited, they occur in 1% to 4% of cases) but extremely dangerous. Fully half of those patients who become infected die as a result of the infection within three years. In addition to being life threatening to patients, site infections are also extremely costly to treat, requiring major surgery and the replacement of expensive devices. The costs for fixing post-implantation surgical-site infections in the US has been estimated at approximately $50,000 per case.

To address this problem, Medtronic has created an antibacterial envelope that is wrapped around the company’s pacemakers and defibrillators and implanted along with the device in the patient’s chest. The envelope dissolves in the weeks after surgery, releasing antibiotics into the pocket around the heart device. The approach has been shown to cut the risk of infection by half, both improving health outcomes and lowering costs. Medtronic is so confident that the antibacterial envelope improves health care value that it is signing innovative risk-sharing agreements with providers and insurance companies in which the company pays substantial rebates toward the cost of removing an infected Medtronic device and implanting a new one, in those situations in which the antibacterial envelope is used but fails to prevent infection.

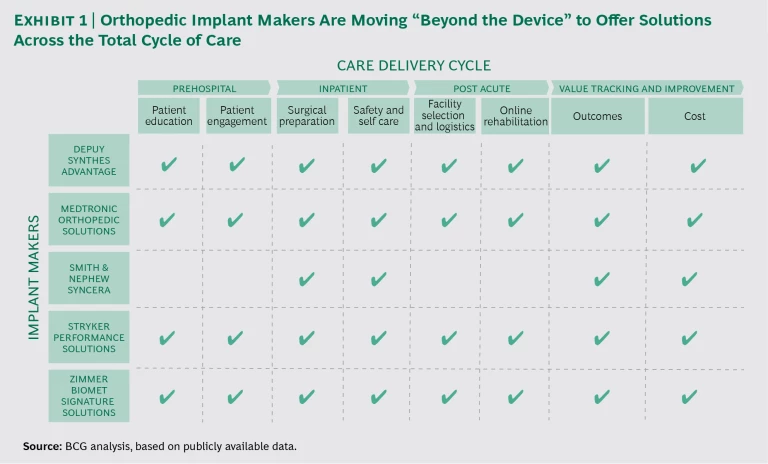

As this example suggests, value-improvement strategies put the focus on providing a comprehensive solution rather than selling a stand-alone product. The trend toward integrated solutions is well underway, for instance, in the orthopedic implant market. In response to the new reality of bundled payments such as Medicare’s CJR program, implant makers have begun to offer a broad range of support services in the areas of patient education and engagement, surgical preparation and operating-room management, postsurgery recovery and rehabilitation, and even outcomes and cost tracking and improvement. (See Exhibit 1.)

Value-based solutions also position medtech companies to take advantage of the recent trend toward value-based procurement. In 2014, the European Parliament passed a directive encouraging public contracting authorities to move away from procurement policies that focus exclusively on price to more holistic approaches that factor in quality, total costs across the product life cycle, and overall value provided to patients. Increasingly, medtech companies are partnering with hospitals and health systems to develop value-based procurement programs focused on solutions rather than just products. (See Procurement: The Unexpected Driver of Value-Based Health Care , BCG Focus, December 2015.)

Value-based solutions are also incorporating new digital capabilities. For example, Zimmer Biomet Signature Solutions combines that company’s traditional consulting services in operating-room and patient management with new “tele-rehabilitation” technologies that allow the company to provide personalized, clinician-supported physical therapy after surgery to patients in their own homes. The goal of the service is to help providers deliver on their new responsibilities for patient outcomes well beyond the surgical procedure itself by speeding postoperative rehabilitation.

New value improvement services like Zimmer Biomet’s represent a major area for growth in the medtech sector. BCG estimates that from 2016 through 2020, the medtech services market will grow by roughly 50%, from $50 billion to $75 billion, with some areas such as process improvement consulting and data collection and analysis growing by as much as 40% per year.

Leveraging Value Measurement

Transparency of relevant, standardized, and timely health outcomes data is the single most important step toward value-based health care. A second strategy that some medtech companies are pursuing is to move into value measurement. Because data collection is highly scalable, it opens up opportunities for companies both to collect data that demonstrates the superior value of their products and services and to develop new data-based offerings that focus on benchmarking and continuous improvement.

The starting point of this trend is the use of outcomes data as real-world evidence in the regulatory approval process.

Take the example of the Transcatheter Valve Therapy Registry. Transcatheter valve therapy is a relatively new technology. The traditional treatment for patients suffering from valvular heart disease has been open heart surgery to insert an artificial heart valve. But many sufferers of the disease (in particular, the elderly and those who have multiple comorbidities) are poor candidates for invasive surgery. Transcatheter valve therapies use a catheter delivery system inserted into an artery or vein and guided by medical imaging to place the heart valve device while the heart continues to beat—a far less invasive approach.

Established in 2012, the Transcatheter Valve Therapy Registry is an innovative US partnership that brings together device makers (Edwards Life Sciences, Medtronic, and Abbott Vascular), leading medical professional societies (the Society of Thoracic Surgeons and the American College of Cardiology), and government regulators and payers (the federal government’s Food and Drug Administration and the Centers for Medicare and Medicaid Services).

Other companies are taking a more proprietary approach, using outcomes data to inform models for risk sharing in reimbursement or even to provide new benchmarking and value improvement services to payers and providers.

For instance, one orthopedic implant maker has accumulated a massive database on health outcomes procedures involving its devices. The company is using this data to drive standardization and the reduction of outcomes variation at its customers, a new capability that the company sees as increasingly central to its value proposition. In the future, it’s likely that some medtech companies will start using such data to create full-fledged data businesses, selling access to data and accompanying analytics such as benchmarking to payers and providers.

Strategies that leverage systematic value measurement are especially relevant to companies that are trying to introduce new devices or therapies. Medtech companies could also play a leading role in outcomes tracking and benchmarking in markets, such as the US, where health systems are highly fragmented and where the network of national quality registries is underdeveloped. At a minimum, medtech companies should actively promote and support national and global efforts to set standards for outcomes measurement.

Investing in Value-Based Care Delivery

Value measurement takes medtech companies substantially beyond their traditional product-based business model. An even more radical strategy is for companies to move decisively into value-based care delivery by building fully integrated supplier and care provision franchises. This approach requires the greatest degree of strategic commitment and considerable investment. But it is also the strategy that, if successful, is most likely to deliver a first-mover advantage because it is an opportunity for a company to “own” care delivery for a given condition or disease. The goal: to become a go-to “shop within a shop” of the larger care delivery ecosystem.

Germany’s Fresenius Medical Care is pursuing this strategy in the domain of end-stage renal disease. Fresenius is the only medtech company that is active across the entire value chain—from selling equipment and dialysis supplies to operating more than 800 centers that provide peritoneal dialysis and hemodialysis to manufacturing and marketing renal drugs. In the US, the company also operates a network of 65 outpatient vascular care and ambulatory surgery centers that not only prepare patients for dialysis treatment but also treat a variety of related conditions. And Fresenius is engaged in a variety of pilots in which the company takes full responsibility for the myriad health issues that frequently afflict patients with end-stage renal disease such as diabetes, cardiovascular disease, and chronic ulcers.

Another recent example is Medtronic’s move into diabetes care. In 2015, the company acquired the Dutch clinic and research center Diabeter, which develops comprehensive, personalized approaches to treat children and young adults suffering from type 1 diabetes.

Diabeter takes a value-based approach to care, founded on the systematic tracking of health outcomes and the creation of multidisciplinary teams of doctors, nurses, dietitians, psychologists, and administrative staff who take joint responsibility for the full cycle of care. As a result, it has been able to achieve some of the best health outcomes for type 1 diabetes patients in the Netherlands. Diabeter has been able to use its demonstrated success at delivering superior health outcomes to win reimbursement approval from Dutch private payers that have not covered its services in the past.

The acquisition of Diabeter gives Medtronic a promising new platform for growth. The company is considering expanding Diabeter’s value-based model to the treatment of the (far larger) population of people with type 2 diabetes. To that end, the company has also acquired a Dutch obesity clinic in order to address metabolic syndrome, one of the main disease mechanisms in type 2 diabetes. Medtronic is also considering replicating the Diabeter model in other markets in Europe and the Middle East.

Not every medtech company will pursue a value-based care delivery strategy. It is most appropriate for conditions like diabetes or cardiac care in which devices play a key role in the ongoing management of the disease, the delivery pathway is clear, the patient group is relatively homogeneous, and solutions are scalable. The approach is less appropriate, however, for situations in which the problems that patients face are more heterogeneous and medical devices play less of a role in standard therapies—for instance, elder care.

Deciding Where to Play

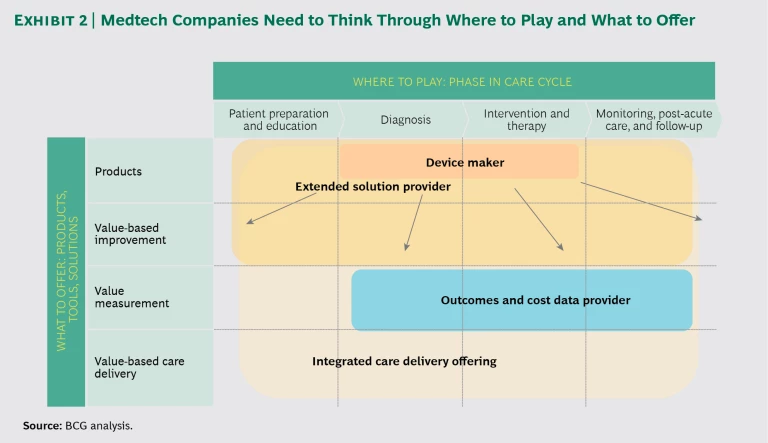

As the various strategies suggest, one of the key issues facing medtech companies will be deciding where to play. Where on the spectrum from device maker to complete health solution provider should a company operate? How far should it move “beyond the device,” whether upstream into patient education and preparation or downstream into rehabilitation, monitoring, and postacute care? Should it consider offering data and health information services in addition to devices? (See Exhibit 2.)

There are four basic steps to answering these questions:

- Size the opportunity. First, determine the size of the opportunity in the therapeutic areas where the company is competing. Are the diseases or conditions large enough in terms of financial impact and is outcomes variation pronounced enough to warrant major investment? If not, are there adjacent therapeutic areas that the company could grow into, through either organic investment or acquisition?

- Map the care delivery cycle. Once the most promising opportunities have been identified, the next step is to map the full care delivery cycle in a company’s target therapeutic areas. What are the leading sources of unnecessary outcomes variation? What are the major drivers of cost? What are the biggest barriers standing in the way of improving the quality of care?

- Develop the solution set. The next step is to develop a comprehensive inventory of potential solutions to address and alleviate the problems. What solutions are most likely to decisively improve health care value? What capabilities would the company have to develop or acquire in order to deliver these solutions? What metrics would need to be tracked in order to demonstrate the success of the company’s offering?

- Design the business model. Finally, a company needs to carefully design a business model that is both financially sustainable and competitively advantaged. Does the company have any existing assets or capabilities that can serve as a first-mover advantage—for instance, a proprietary database that will allow it to learn faster than its competitors and improve its offering more quickly? If not, is there a pathway to develop such assets—for example, by leveraging the company’s existing category leadership or by partnering with leading providers in the development of new products, solutions, or care pathways? Are there specific customer segments that will unlock the most value and, therefore, should be the focus of the company’s efforts?

These four steps are the basic activities of corporate and business strategy. When it comes to the medtech industry’s response to value-based health care, the time for strategy is now.